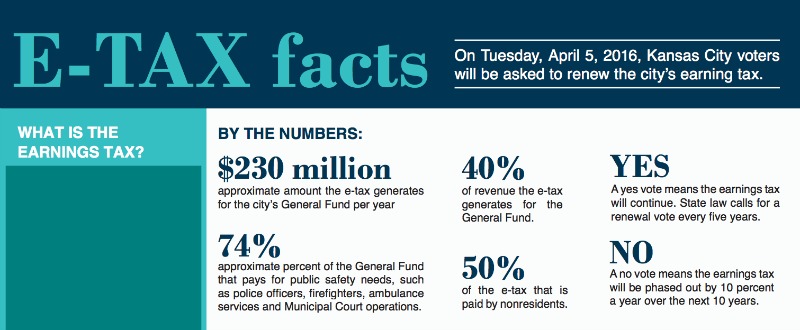

On April 5th, residents of Kansas City, Missouri will have on the ballot the choice of whether or not to maintain the Kansas City earnings tax for the next five years. The purpose of this article is to provide readers information before they go to the polls.

Facts about the Kansas City Earning Tax

The ballot issue is not asking residents of Kansas City to approve a new tax or a tax increase. Kansas City’s Finance Department reports the Kansas City earnings tax brings in 40% of the city’s general fund every year—that’s $230 million. This tax is paid by anyone who lives or works in Kansas City, Missouri. Retired Kansas Citians do NOT pay the earnings tax. Kansas City, Missouri and St. Louis, Missouri are not the only communities collecting an earnings tax. Over 4,000 cities in America have an earnings tax and none of them have 325 square miles of infrastructure to maintain.

Proponents for keeping the Kansas City earnings tax state without the earnings tax, Kansas City will lose the ability to pick up trash, keep our streets clean and maintained, and pay for our police, fire, and ambulance service. The State of Missouri maintains it has one of the lowest tax rates around. In order to keep this position, the State must shift the responsibility of paying for existing public services to local municipalities’ budgets. With the elimination of the revenue generated by the e-tax, it is projected the City will have 810 fewer uniformed police officers and 550 fewer firefighters over a 10 year period.

It is estimated 50 percent of the earnings tax is paid by people who DON’T live in Kansas City. Who will help the City make up the deficit if the tax is not renewed? Without the renewal of the earnings tax, the burden will fall entirely on Kansas City residents – including retired Kansas Citians who don’t currently pay the earnings tax – to make up the lost revenue.

Eliminating the earnings tax does not stop the over 50% of non-Kansas City residents working in Kansas City from traveling on Kansas City, Missouri streets, expecting snow removal on those streets, or expecting Kansas City, Missouri to provide public transportation and police or fire protection during working hours.

Those opposing the earnings tax want voters to know if the earning tax is eliminated, the tax would not disappear immediately but be phased out over 10 years, allowing the City time to find other resources to make up the projected annual $230 million loss. The City’s property tax raises $56 million a year for the general fund. If Clay, Platte, and Jackson county worked with the City of KCMO to manage the assessed value of houses and businesses to keep them in line with other municipalities in the metro, the City could possibly double or triple the real property tax of Kansas City residents.

Kansas City, Missouri sales tax could be another resource to close the revenue earning tax gap. Voters could be asked to approve an additional sales tax. Per a study from Missouri Show-Me State, Kansas City and St. Louis are not yet the highest local sales tax in the 46 states collecting sales tax. In 2014, Kansas City tied with St. Louis in being the 6th highest local sales tax city before adding in special taxing district sales tax percentages.

Within the city limits of Kansas City, Missouri, sits a number of public facilities visited or used by residents of other municipalities within the Kansas City metro area. Should the voters of Kansas City, Missouri chose to eliminate the earnings tax, the City could raise the admission fees or ticket prices for these facilities to help generate revenue to maintain them, pick up the trash around them, and preserve them as Kansas City landmarks.

A yes vote means the earnings tax will continue. State law calls for a renewal vote every five years.

A no vote means the earnings tax will be phased out by 10 percent a year over the next 10 years.

Remember to get out on April 5th to vote! Polls will be open from 6 a.m. to 7 p.m. For information about polling locations, please visit www.kceb.org or call 816-842-4820.

More information about Earnings Tax may be found on the City of Kansas City, Missouri’s website: http://kcmo.gov/tax/etax/